Why am I paying more for my Part B Medicare coverage?

Why is my Prescription Drug coverage higher than others?

This is a perfect time to answer these questions based on the fact that higher premiums have had to be paid for three out of my last five Medicare clients.

The answers can be different for each client, but let’s first address the first question about Medicare Part B costs.

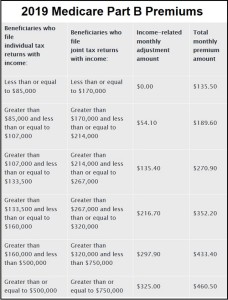

You do pay a premium for your Part B Medicare coverage. In 2019, that cost is $135.50 each month for most people. If, however, your modified adjusted gross income is above a certain amount, you may have to pay for a Income Related Monthly Adjusted Amount (IRMAA). Medicare will use your modified adjusted gross income from two years prior.

If your modified adjusted gross income is above a certain amount, you will pay for the standard premium of $135.50 (2019) plus an additional cost of the Income Related Monthly Adjusted Amount. To give you an idea of what to expect, this chart may help:

In some cases, there are people that do not enroll into Part B when they are first eligible. They may wait because they currently have health insurance through their employer. If you have credible coverage through an employer (your plan must meet guidelines that Medicare sets), you will not have to enroll into Part B right away and no extra costs will be associated with your Part B premiums once you enroll into Part B.

With that said, if you do not have credible coverage and wait to enroll into Part B, you will have to pay a late enrollment penalty. That penalty will last for as long as you have Part B.

The same can be said for Medicare Prescription Drug Plans.

You can get a Medicare Prescription Drug plan through enrolling into a Medicare Advantage plan that has prescription drug coverage or enrolling into a Medicare Prescription Drug Plan. Prescription Drug Plans are not required for you to enroll into, however, if you don’t enroll into a plan when you are first eligible and then enroll late, you will pay a penalty that will last as long as you have that prescription drug plan. Again, if you have credible prescription drug coverage, you will not have to pay a penalty.

Although answering these questions may not be the same for everyone, it is important to note that in most instances, penalties could have been avoided.

At Balanced Care, we realize that our clients will want to work beyond the age of 65 and keep their health insurance coverage through their employer.

We realize that clients may not take prescription drugs when they are first eligible for Medicare.

It is our responsibility to make sure you know what to expect with costs and the consequences of not enrolling when you are first eligible.

At Balanced Care, we don’t like surprises.

We don’t want you to be surprised by a penalty or an extra payment that you didn’t anticipate.

Terri Trepanier is the owner of Balanced Care Health and Supplemental Insurance and a licensed insurance consultant and broker with Associated Brokers. Licensed in both Maine and NH, her specialty is working with small businesses, individuals, and families with their health and life insurance needs. She is certified to offer health plans both on and off the exchange and is contracted with every health insurance company that offers plans in both New Hampshire and Maine. Her other passion is assisting Medicare beneficiaries with their Medicare Supplemental, Medicare Part D Prescription Drug Plans, and Medicare Advantage plans. Terri has seen firsthand the importance of insurance products and how they help families. Her goal with Balanced Care is to “Insure Security and Peace of Mind One Family at a Time”.